Smd Led Strips,Led Flexible Light Strip,Mini Pcb Light Strip,High Density Led Light Strips Top Lighting International (HK) Co., Limited , https://www.topled-group.com At present, the prices of mainstream products in the steel market continue to fall sharply, cost support continues to weaken, crude steel production is still at a high level, downstream demand continues to be light, social steel stocks are still at a high level will suppress the formation of steel prices, the short-term market will maintain the decline.

At present, the prices of mainstream products in the steel market continue to fall sharply, cost support continues to weaken, crude steel production is still at a high level, downstream demand continues to be light, social steel stocks are still at a high level will suppress the formation of steel prices, the short-term market will maintain the decline.

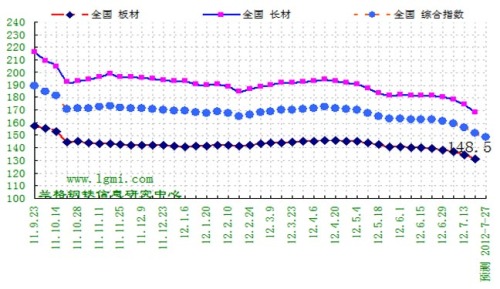

According to the Lange Steel Information Research Center weekly price forecasting model data, next week (2012.7.23-7.27) the domestic steel market price will continue to drop sharply, and the long product and sheet market prices will continue to fall sharply and fall slightly. The Lange Steel Composite Index is expected to fluctuate around 148.5 points. The average price of steel is around 3860 yuan, with an average drop of around 60 yuan.

From the market research of the Lange Steel Information Research Center, it is expected that prices of domestic long products and sheet metals will continue to fall sharply next week (2012.7.23-7.27); raw material market prices will decline slightly, coke, iron ore, scrap and Billet prices will decline slightly.

1. The domestic steel market continued to drop sharply this week. In the 29th week of 2012 (7.16-7.20), the Lange Steel (LGMI) Composite Price Index reached 151.2 points, a decrease of 3.20% on a week-on-week basis and a decrease of 21.74% from the same period of last year. Among them, the LGMI long products price index was 167.9 points, down 3.68% on a week-on-week basis and down 24.11% from the same period of last year; the LGMI sheet price index was 131.1 points, down 2.45% on a week-on-week basis and down 17.78% year-on-year (see Figure 1 for details). .

According to the price data of 17 categories of 33 standard varieties monitored by the market of Lange Steel Information Research Center in the market, the market price of major steel products continued to fall sharply in the 29th week of 2012 (7.16-7.20), compared with last week, the number of rises A slight decrease, a slight decrease in the number of flats and an increase in the number of declines. Among them, there was no increase in variety, which was a decrease of two kinds compared with last week; three kinds were flat, three kinds decreased compared with the previous week; 30 varieties fell, and increased by five kinds from last week. The domestic steel and iron raw materials market dropped slightly. The iron ore market price dropped by 20 yuan, the coke market price by 40 yuan, the scrap market price by 60 yuan, and the billet market price by 120 yuan.

2. This week, the national steel society stocks began to decline again. At present, the national steel society stocks began to decline again after rising for three consecutive weeks. Among them, the stocks of building materials went up from down to down, and the rate of decline in sheet stocks was basically stable. According to the market monitoring of Lange Steel Information Research Center, on July 20, the national steel society stocks were 157.5534 million tons, a decrease of 71,500 tons from the previous week. From the perspective of sub-species: China's wire rods have a social inventory of 1,475,200 tons, down by 2.36% from the previous week; rebar social stocks are 6,430,400 tons, down 0.30% from last week; the inventory of the social stock of the coils is 449,900 tons. This was an increase of 0.73% over the previous week; the social volume of hot coiled coils was 4,173,900 tons, down 0.14% from the previous week; the social volume of cold coiled coils was 1,651,600 tons, down 0.42% from last week; the plate's social inventory The amount was 1,670,200 tons, a decrease of 0.43% from the previous week.

3. Steel market continued to fall sharply this week. The 29th week of 2012 (7.16-7.20) The rebar market continued to fall sharply, and prices continued to hit new lows. The overall situation was extremely weak. The settlement price of this week fell by 191 points, and the decline was larger than last week. There was a tendency to accelerate the decline. This week, the main contract is 1,309.992 million lots, with an increase of 316,000 lots. The position is once again expanding, and the range of positions approaching 1 million lots will generally cause greater market volatility.

4. Concern about the recent factors affecting steel prices Macroeconomics:

In the first half of the year, state-owned enterprises realized profits of 1,020.38 billion down 11.6% year-on-year

From January to June 2012, the total operating revenue and taxes payable of all state-owned and state-controlled enterprises (hereinafter referred to as state-owned enterprises) included in the statistical range of this month’s report continued to grow year-on-year, but the increase in cost and expense was higher than the increase in income and realized profits. keep falling. From January to June, state-owned enterprises realized a total operating income of 198453.6 billion yuan, an increase of 11.1% year-on-year, and an increase of 8.8% in June from May; total state-owned enterprises realized a total profit of 1,102.38 billion yuan, a year-on-year decrease of 11.6%, compared with 5 in June. The monthly growth rate was 20.6%. From January to June, the industries that achieved a larger year-on-year increase in profits were the ** industry, the automotive industry, and the post and telecommunications industry. The industries that achieved a larger year-on-year decline in profits were the transportation industry, chemical industry, non-ferrous industry, petrochemical industry, and building materials industry.

The electricity consumption in the first 6 months increased by 5.5%. The growth rate of the industrial electricity use fell sharply. The China Electricity Regulatory Commission issued the first half of the electricity operation in the first half of the year in the first half of the year. In the first half of the year, the electricity industry in the country was generally stable, affected by the slowdown in economic growth and other factors. The growth rate of power demand has clearly declined. Before the supply and demand of electricity, it is loose and basically balanced. Since March, there has been no problem of power cuts and power shortages in the country. In the first half of the year, the growth rate of electricity consumption in the entire society continued to slow down. From January to June, the entire society used 2377.4 billion kWh of electricity, an increase of 5.5% year-on-year, and the growth rate was down 6.7 percentage points from the same period of last year. The growth rate of electricity growth in the second industry was large. From January to May, the electricity consumption of the secondary industry increased by 3.76% year-on-year, which was lower than the 2.06 percentage point growth rate of electricity consumption of the entire society. In the first half of the year, the growth rate of industrial electricity continued to be lower than the growth of electricity consumption in the entire society. Since January, the growth rate of industrial electricity continued to be lower than the growth rate of electricity consumption in the entire society. In the main electricity industry, the ferrous metals and building materials industry continued to grow negatively. The growth rate of electricity consumption in the central and western regions has obviously declined. From January to June, in the 16 provinces (autonomous regions and municipalities directly under the central government) where the growth rate of electricity consumption was lower than the national average, 9 in the Midwest, and in the 4 provinces with negative electricity growth in the month of June, the Midwest accounted for Three.

The first half of real estate ** growth rate rebounded, housing development loans surged 62.7%

The central bank issued data on July 19. At the end of June, the balance of major financial institutions, rural cooperative financial institutions, urban credit cooperatives, and foreign-invested banks was 11.32 trillion yuan, a year-on-year increase of 10.3%, which was higher than the end of the previous quarter. 0.2% in the first half of the year, an increase of 565.3 billion yuan, a decrease of 27.1 billion yuan year-on-year, the first half of the increase accounted for 12.3% of the increase in the same period, 2 percentage points higher than the proportion of the first quarter. At the end of June, the balance of real estate development ** was 80.3 billion yuan, a year-on-year increase of 0.8%, an acceleration of 8.8 percentage points from the end of the previous quarter. The balance of real estate development** was 2.92 trillion yuan, an increase of 11.3% year-on-year, 0.3 percentage points higher than the end of the previous quarter. The balance of personal purchases** was 7.49 trillion yuan, an increase of 11% year-on-year. The growth rate was 1.1 percentage points lower than that at the end of the previous quarter; the increase in the first half was 345.5 billion yuan, a deceleration of 222 billion yuan year-on-year. At the end of June, the balance of affordable housing development** reached 478.4 billion yuan, a year-on-year increase of 62.7%, a growth rate one percentage point lower than the end of the previous quarter. In the first half of the year, it increased by RMB 86.9 billion, accounting for 49.7% of the increase in property development during the same period, which was 2.6 percentage points higher than that in the first quarter.

Raw material supply:

BHP Billiton's iron ore production hits a record high for 12 consecutive years BHP Billiton reported that its iron ore production in Western Australia has reached a record high for the 12th consecutive year. The current fiscal year's output growth will be reduced. The company's iron ore output increased by 19% to 159.5 million tons in the fiscal year ended in June, and its output in the fourth quarter rose by 15% year-on-year. BHP Billiton expects iron ore production to increase about 5% in the current fiscal year.

Rio Tinto produced 120 million tons of iron ore in the first half of the year The global mining giant Rio Tinto announced on the 17th that its iron ore production in the first half of this year reached 120 million tons, an increase of 4% over the first half of last year. Record a new high. According to the data, Rio Tinto’s iron ore production in the Pilbara region of Western Australia increased by 4% year-on-year to 114 million tons, and iron ore sales in this region were 109 million tons, of which more than 40% were average quarterly prices. The quarterly pricing is determined and the remaining 60% are priced according to the current quarterly, monthly average price index or spot price index.

Industry News:

China Steel Association: In the first half of July, the national crude steel production per day was 1,957,100 tons. According to the statistics of the China Iron and Steel Association (Xinhua Iron and Steel Association) Xunbao, in early July 2012, the key statistics steel enterprises produced a total of 16.5744 million tons of crude steel, 164.777 million tons of pig iron, and 1.71 million tons of steel. . The daily output and increase/decrease ratio over the previous ten days were: 1.775 million tons of crude steel, 0.44% increase in output of 0.72 million tons, 1.648 million tons of pig iron, an increase of 3.11 million tons of increase in output of 2.11%, 1.571 million tons of steel, and a reduction of 58,800 tons of steel. 3.60%. Based on this estimation, the country produced a total of 1,958,700 tons of crude steel, 18,268,900 tons of pig iron and 26,321,500 tons of steel during the current period. The average daily production was 1,958,100 tons of crude steel, 1,829,900 tons of pig iron and 2,623,200 tons of steel. As of the end of this year, this year the country produced a total of 3,748,905 tons of crude steel, 3,508,900 tons of pig iron, and 48,985,270 tons of steel; the average daily output of crude steel was 1,951,100 tons, pig iron 1,827,100 tons, and steel 2,551,300 tons.

The thread of the last period fell by 20 days and the main contract fell by 2.24%

The rebar main 1301 contract was opened at 3,822 yuan/ton in the morning on the 20th, and then the price accelerated throughout the day. The lowest was 3,747 yuan/ton for the whole day, and the highest was 3,824 yuan/ton, and it was closed at 3,705 yuan/ton compared with the previous day. (19th) The settlement price fell 86 yuan/ton, and the transaction volume was 1,159,334. Hand positions were 991,670 lots, an increase of 104,844 lots.

Downstream demand:

The Ministry of Railways has reduced its capital investment by 38.6% in the first half of this year

According to statistics from the Ministry of Railways, in the first half of this year, the total investment in fixed assets completed by the national railways was 177.751 billion yuan, a year-on-year decrease of 36.1%, of which capital construction investment was 148.706 billion yuan, a year-on-year decrease of 38.6%. According to the plan of the Ministry of Railways, the total scale of the national fixed-railway investment plan for 2012 is 516 billion yuan, of which the capital construction investment is 406 billion yuan.